Where is GreenRock financing available?

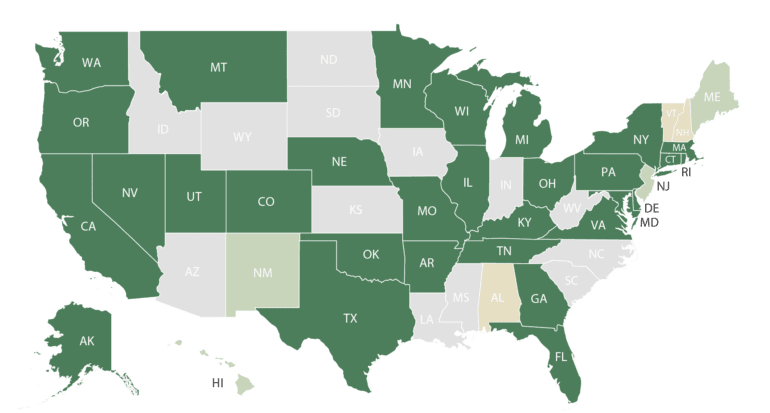

While PACE enabling legislation has been passed in 39 states and the District of Columbia, many of the PACE programs have differing processes, fee schedules and funding guidelines. GreenRock is your partner in all things C-PACE. From a single asset to a large portfolio, owners using our PACE 360 process can quickly determine where PACE may be applicable and how it can be deployed for the benefit of all stakeholders.

Image Credit: PACENation

Active Program(s)

Program in Development

PACE-enabled

Not PACE-enabled